The U.S. relies on mango imports primarily from South America during the winter months. Mango production in Peru and Ecuador has been significantly impacted by the El Niño phenomenon, which led to elevated temperatures during the critical flowering stage and thereby exerted a detrimental effect on overall yields.

A compounding factor exacerbating the challenges faced by the Peruvian mango industry is the decline in production within the Áncash region which has caused significant economic losses within the sector, as reported by the Service for Comprehensive Rural Development (Sedir). Furthermore, the escalation in cultivation input costs, soaring by 200%, has added an additional layer of strain. In regions such as Piura and La Libertad, mango production has been adversely affected, experiencing declines of up to 90% and 75%, respectively, resulting in a noticeable reduction in shipments through the port of Paita, a key hub for mango exports.

Ecuador faces a potential decrease in production ranging from 60% to 75%, contingent upon the duration of the harvest, as per insights from The Mango Ecuador Foundation. In stark contrast, Brazilian mango exports are poised for a favorable end to the year, with substantial contributions from Bahia, the nation’s leading fruit exporter. Unlike the previous year, international shipments from Bahia are anticipated to exhibit a robust 19% increase compared to 2022.

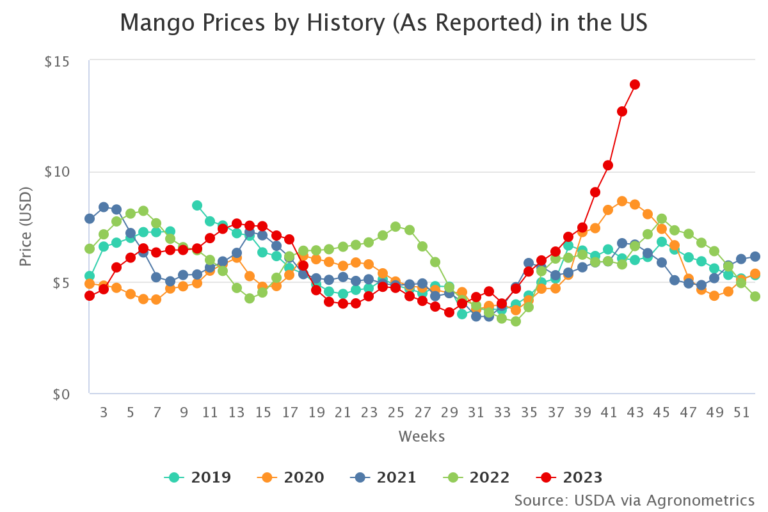

Given that demand is in line with what is expected this time of year, it outpaces supply; prices have reached record high levels this season, going as high as $13.90 per package in week 43. The industry’s adeptness in navigating these challenges will be pivotal in ensuring the resilience and sustainability of the mango market in the weeks ahead.